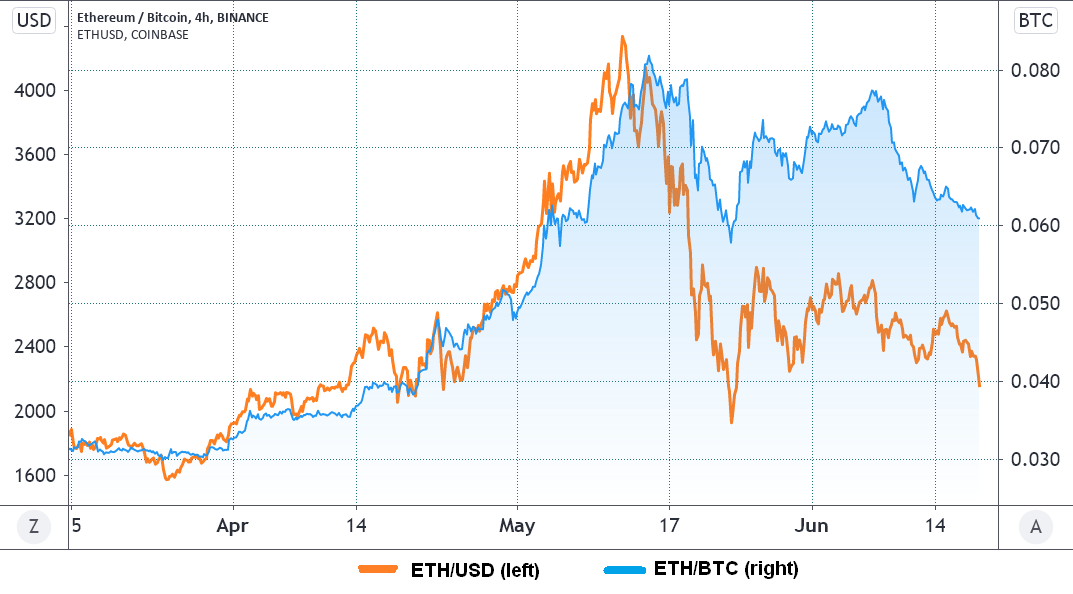

Ether (ETH) cost totaled Bitcoin (BTC) by 173 percent from March 28 to May 15. The unbelievable bull resulted in the token to achieve a 4,380 all-time high. However, as cryptocurrency markets pioneered a sharp fall on May 12, the trend started to reverse, and ever since that time, Ether has underperformed by 25%.

Some may say it’s a technical adjustment after a powerful rally. While this partially explains the movement, it excludes some critical factors, including the fast progress of smart-contract network competitors and Bitcoin being embraced as an official money for the first time.

Mike Novogratz could have been misinterpreted in his interview

Ether’s bull run potentially got an excess leg due to intense praise from institutional investors. Dealers might have picked up a feeling of urgency, known as FOMO, and immediately shifted their Bitcoin vulnerability towards the leading altcoin.

On May 13,“ New Yorker magazine published an interview with Mike Novogratz, the founder, and CEO of Galaxy Digital. In the dialog, Novogratz stated:

„All of a sudden, you have decentralized finance and NFTs both on Ethereum at the same time approximately, with uncontrolled accelerating expansion.“

Novogratz was subsequently questioned on how much greater Ether could attain, to which he answered:

„You know, it is dangerous to give predictions about the highs. But could it get to $5,000? Of course it might.“

While an Ethereum holder may have interpreted it as a prediction, others might have known it as a wild guess, likely based on overall crypto market conditions.

But roughly a week after, a report from Goldman Sachs revealed the global investment bank thought that Ether had a“high probability of overtaking Bitcoin as a dominant store of value.“ Interestingly, among the main quotes in the report was straight from Novogratz’s interview with the New Yorker.

At its peak, Binance Chain commanded 40 percent of DEX volume

While Ethereum has retained its 80% dominance on net worth locked in decentralized finance (DeFi) applications, Binance Smart Chain (BSC) has attained a 40% market share on DEX exchanges.

The successful rise of this DeFi industry and non fungible token (NFT) markets caused intense congestion on the Ethereum network, raising median fees to $37 in mid-May. This bottleneck triggered an activity exodus to competing networks, and PancakeSwap was best positioned to catch that flow.

Related: Here is why one analyst claims Bitcoin will outperform Ethereum in the Brief term

To make things worse, important DeFi projects expanded to Binance Smart Chain, such as yield aggregator Harvest Finance and decentralized exchange aggregator 1inch. Investors quickly realized the trend could last as the competing smart-contract network provided a simple solution for dApps looking for cheaper alternatives.

No Nation is adopting the’Ethereum standard‘

Bitcoin may have had a subpar performance within the past 30 days since it’s failed to break the 42,000 resistance multiple times.

Following the Central American nation made the decision legislation, a few other Central and South American countries started discussing the benefits of carrying a similar route.

Ethereum is undertaking a redesign which will alter the issuing rate and how entities become paid to secure the network by moving away in the Proof of Work model. Meanwhile, the Bitcoin is making certain every update is backward-compatible and maintaining its own rigorous monetary policy.

That is the chief reason why Ether will not outperform Bitcoin over the subsequent 12 weeks, or at least until there’s a better comprehension of how Ethereum network dominance of smart contracts will probably be.

Professional investors avoid uncertainties at all costs, and cryptocurrency markets present plenty of that. There’s just no reason for institutional investors to ignore the risks while competing networks consume Ethereum’s lunch.

The views and opinions expressed here are solely those of this author and do not necessarily reflect the views of CoinNewsDaily. Every investment and trading movement involves danger. You need to conduct your own research after making a determination.