Since setting its record high of $4,867 on Nov. 10, 2021, Ether (ETH) has lost more than 20% of its value. However, the sharp price drop doesn’t mean that ETH can’t reach a new record high in the next few months, as several well-known technical, macroeconomic, and on-chain indicators suggest.

One of these indicators thinks that Ether’s price will reach $5,000 in the first quarter of 2022. Other indicators look like they’re ready to support the bullish bias.

ETH price painting falling wedge

Ether’s recent price correction is painting a possible classic bullish reversal pattern called a „falling wedge,“ which looks like it could happen.

It’s important to know that falling wedges are wide at first, but they get smaller as the price goes down. As a result, the price moves in a conical shape that goes down as the reaction highs and reaction lows meet. After the price decisively breaks above the wedge’s resistance, traders know that the market is going to go up.

There are still a lot of people who think ETH will break above its falling wedge resistance in the next few days. if that were the case, it would rise by that much, or as much as the distance between the wedge’s upper and lower trend lines when measured from its breakout point.

Literally unchanged…$ETH is going to $5k pic.twitter.com/11mAQiJxJS

— Kong Trading (@KongBTC) January 4, 2022

That roughly puts the price target for Ether at $5,000.

ETH deposits to exchanges drop

They move tokens to exchanges when they want to sell or trade them for either fiat money, stablecoins, or other cryptocurrencies.

Usually, when there are more transactions on crypto trading platforms, that means there is a lot of selling going on in the market. However, if the number of token transactions drops, it shows that people are more likely to keep their money in the market.

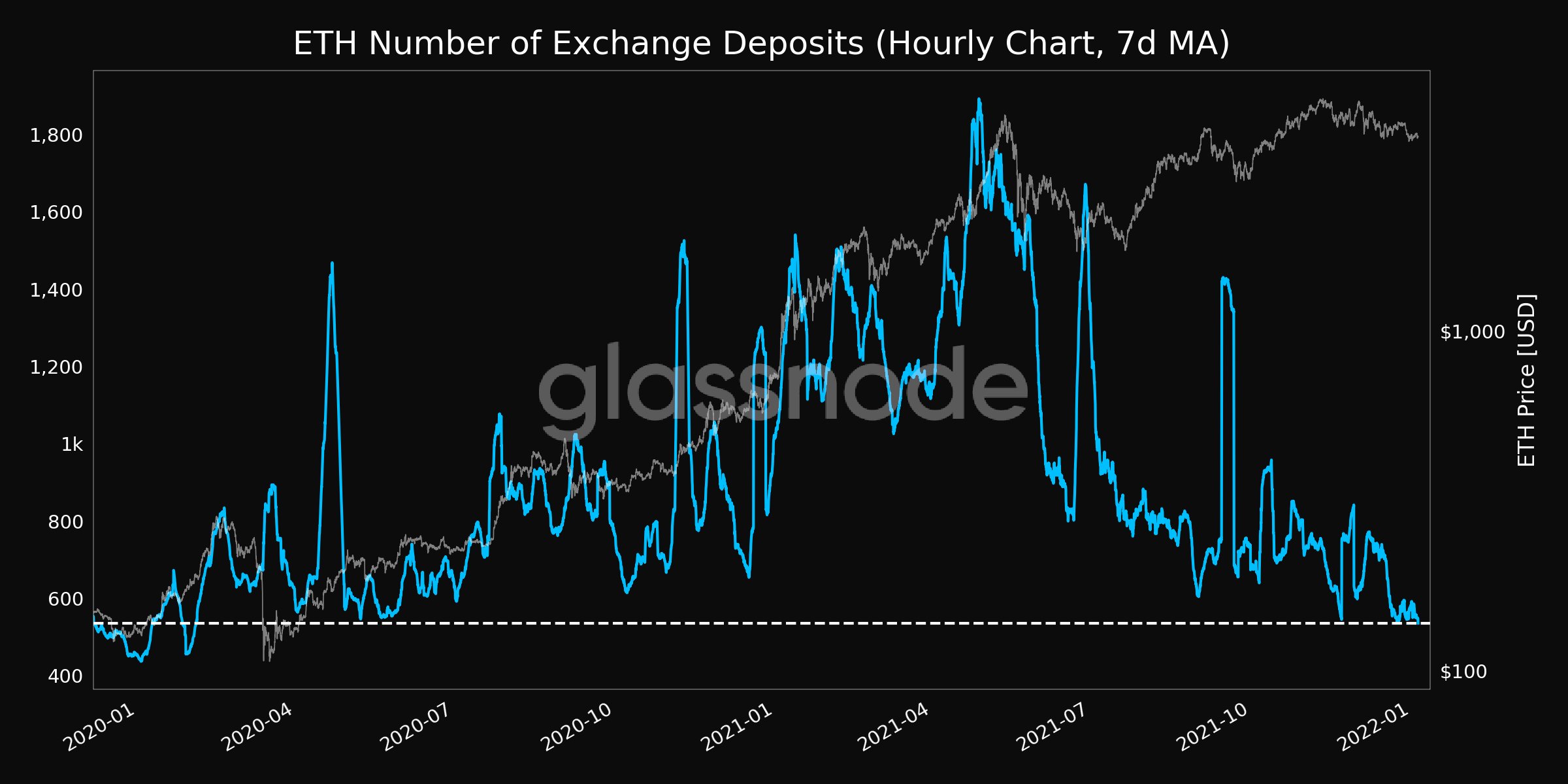

According to Glassnode, the number of Ether deposits to exchanges dropped to its lowest level in more than two years on Jan. 3.

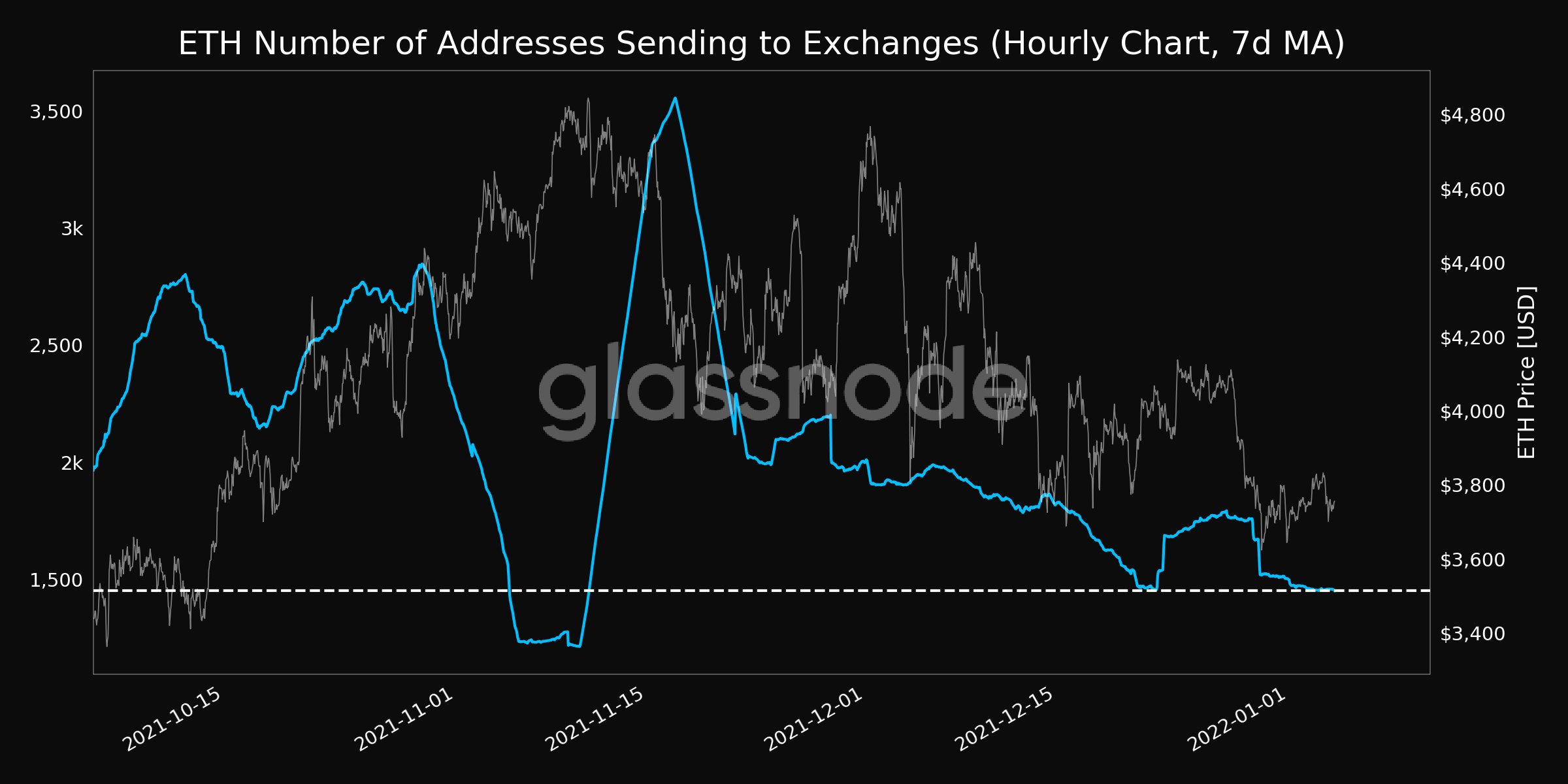

Another Glassnode metric that tracks how many Ether addresses send ETH to exchanges also fell over the last 30 days, the same time that the ETH/USD rate dropped almost 11%.

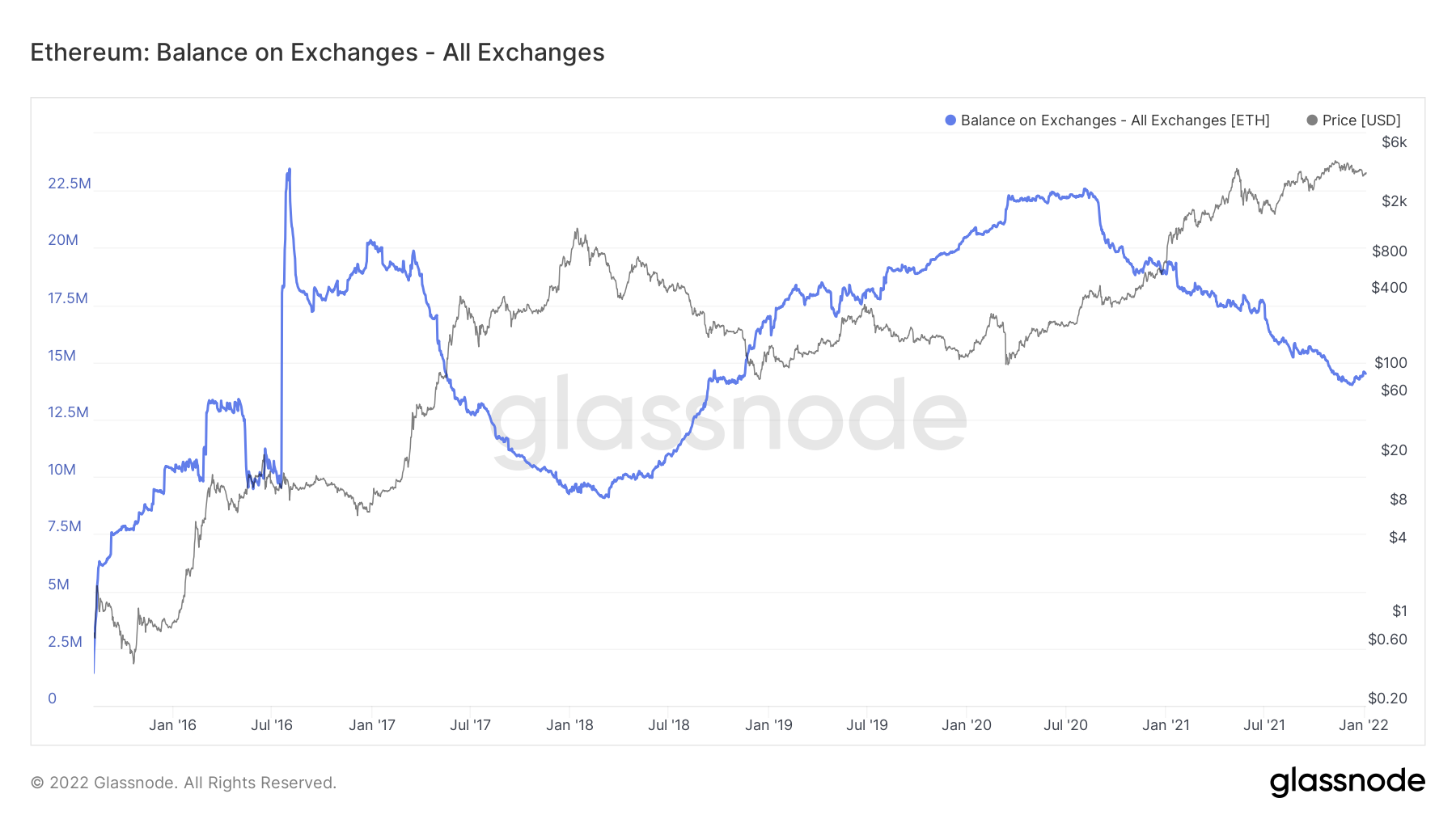

The total balance of Ether on all the exchanges has been going down since August 2020, which means that ETH investors are in it for the long run, even though the price of ETH rose from almost $400 to about $3,800 in the same time.

Cheap money here to stay?

In the wake of the Federal Reserve’s hawkish turn, Ether’s $1,000-plus drop from Nov. 2021 to now came a lot.

The U.S. central bank decided to speed up the withdrawal of its $120 billion a month asset purchase program, followed by three rate rises in 2022 from its near-zero level. This move was made to stop rising prices. Its monetary policy was one of the main factors behind the rise in prices of Ethereum, Bitcoin (BTC), and other crypto markets.

He also said that investors should put at least 2% to 3% of their net portfolio into cryptocurrencies like Bitcoin and Ethereum in case the fiat money „goes to hell.“

Ray Dalio, the founder of Bridgewater Associates, also said that he has been keeping BTC and ETH in his portfolio to protect against the risks of cash devaluation caused by inflation.

The author’s thoughts and opinions are entirely his or her own and do not necessarily reflect those of CoinNewsDaily. Each investing and trading action entails risk; before making a decision, you should conduct your own research.