As a startup, Chainlink solves a major impediment that fears transferring data in between blockchains and the real earth.

The protocol, whose origins day back again to September 2014 – a period when half of the entire world have not even heard about blockchains and Bitcoin, presented a resolution that permits independent information resources to feed info into public ledgers by way of a decentralized oracle community.

Flash ahead to 2020, Chainlink is now portion of 315 blockchain initiatives, together with decentralized finance protocols, information providers, blockchain nodes, and whatnot.

#Chainlink ecosystem growth under no circumstances slows with 29 new Oct integrations ????

Full $Backlink integrations 315 – together with:

74 #blockchains

98 #DeFi

23 #information vendors

44 nodes and additional!Watch all here: https://t.co/ZUaUvFgUSd

Is your #smartcontract #PoweredByChainlink

It should really! pic.twitter.com/IdCX65zNYa

— TheLinkMarine ???? (@TheLinkMarine1) November 1, 2020

Chainlink’s achievements is also seen in its market capitalization, which has surged to $4.275 billion from $101 million in just two a long time. By natural means, the upswing has also pushed the price of Url, Chainlink’s in-property token, increased it was a short while ago up by additional than 17,000 % due to the fact launch.

But inspite of Chainlink’s progress as an oracle protocol, the overall performance of its token remains uncovered to the provide-and-demand from customers dynamics. The Website link/USD exchange fee topped at $20.71 in August 2020. The pair later seasoned a considerable sell-off. The transfer introduced its price down by as a lot as 64 % – as of September 23.

LINK’s plunge was a item of a bearish technological set up. As normal, the token bounced back again, logging a 79.18 percent recovery. Nonetheless, it remained less than bearish stress as a mix of specialized and basic indicators pointed to an prolonged downside bias among the traders.

In this article are three factors why Hyperlink has additional place to tumble in the coming sessions.

#1 New Addresses

The initially bearish setup for Backlink occurs from its deal with depend.

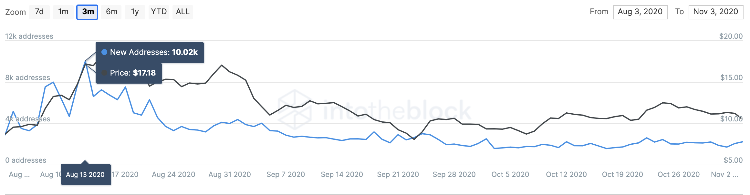

Data fetched by IntoTheBlock exhibits that the variety of new Website link addresses has hardly moved in the very last 30 times. The Chainlink community is at this time introducing an normal of 2,000 addresses every day. At its very best in August, the challenge was integrating about 10,000 a working day.

Chainlink's new addresses are declining. Resource: IntoTheBlock

That demonstrates an 80 % decline. In the meantime, IntoTheBlock further more claimed that about 800 Backlink whales with balances between 1,000 to 10,000 Website link still left the Chainlink community forward of the Oct shut. That also shows that serious traders are marketing their Backlink holdings.

#2 Bitcoin Dominance

Chainlink’s reliable extended-expression fundamentals have also fallen prey to a increasing Bitcoin dominance in the general cryptocurrency current market amid the US presidential election.

Additional and a lot more traders have reallocated their funds into Bitcoin, believing the cryptocurrency would be at the forefront of the winners that will advantage from the 2nd coronavirus stimulus bundle. The bill arrived at an deadlock in the US Congress immediately after the Democrats and the Republicans entered negotiations around its measurement.

Bitcoin bulls feel that a obvious acquire for the Democratic prospect Joe Biden would have him prove the vast majority in the Senate. The Democrats want a huge aid fund for Americans. So their elevation into the Senate Residence would necessarily mean far more dollar liquidity for the US financial system.

Bitcoin touched its a few-yr high this week on "blue sweep" hopes. Resource: BTCUSD on TradingView.com

As a end result, the greenback’s buying ability will dip and, in turn, would mail the Bitcoin selling prices increased.

As a result, traders feel it is wiser to maintain their money locked in the Bitcoin industry. That has harm Backlink in the brief-phrase.

#3 Hyperlink Bear Flag and 30% Price Correction

With two concretely bearish fundamentals lurking around Url, a complex set up is more validating the draw back outlook for the token. It has to do with a “Bear Flag.”

Website link bearish setup. Resource: LINKUSD on TradingView.com

The bearish continuation pattern commonly surfaces during a downtrend. It appears like an upward channel immediately after a strong shift downside but at some point breaks beneath the decrease trendline to go on heading decreased. The suitable bearish focus on here is as reduce as the top of the pole (downward arrow in the chart above).

Nonetheless, Url has suitable support concentrations even if it breaks underneath the Bear Flag pattern. The initially of this sort of value flooring is at $7.15, almost 30 p.c decrease. The second a person is at $4.90, down 50 % from the present concentrations.

If the fundamentals earlier mentioned persist, then the Backlink/USD pair could test $7.15 for a rebound.