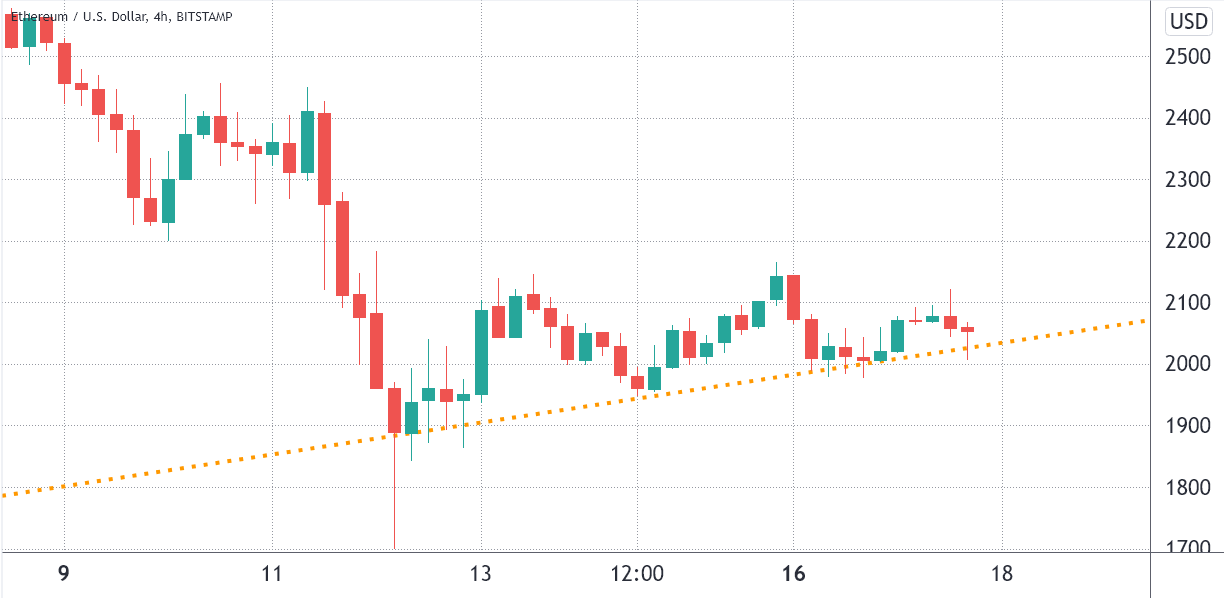

Ether (ETH) price has been trying to establish an ascending channel since the May 12 market-wide crash that sent its price to $1,790. Currently, the altcoin’s support stands at $2,000, but the high correlation to traditional markets is causing traders to be highly skeptical s cryptocurrency market recovery.

To date, the Federal Reserve continues to dictate the markets’ performance and uncertainty has been the prevailing sentiment because the central banks of major economies are trying to tame inflation. Considering that the correlation between crypto markets and the S&P 500 index has been above 0.85 since March 29, traders are likely less inclined to bet on Ether decoupling from wider markets anytime soon.

Currently, the correlation metric ranges from a -1, meaning select markets move in opposite directions to a +1, a perfect and symmetrical movement. Meanwhile, 0 would show disparity or a lack of relationship between the two assets.

U.S. Federal Reserve Chairman Jerome Powell emphasized on May 17 his resolve to get inflation down by raising interest rates until prices start falling back toward a „healthy level.“ Still, Powell cautioned that the Fed’s tightening movement could impact the unemployment rate.

So from one side, the traditional markets were pleased to be reassured that the monetary authority plans a „soft landing,“ but that doesn’t reduce the unintended consequences of achieving „price stability.“

Regulatory uncertainty also had a negative impact

Further pressuring Ether’s price was a document published on May 16 by the U.S. Congressional Research Service (CRS) that analyzes the recent TerraUSD (UST) debacle. The legislative agency that supports the United States Congress noted that the stablecoin industry is not „adequately regulated.“

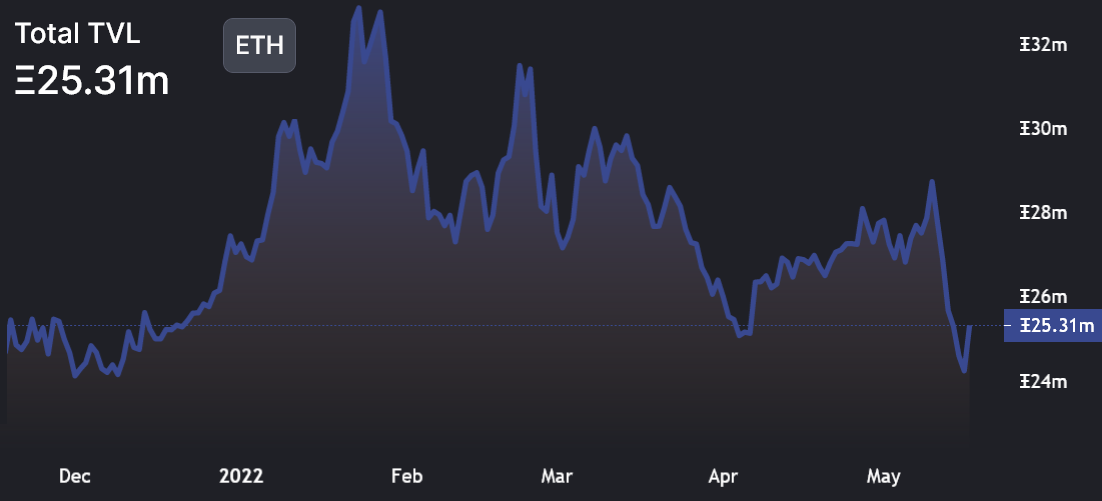

In the same time, the Ethereum network’s total value locked (TVL) has dropped by 12% from the previous week.

The network’s TVL dropped from 28.7 billion Ether to the current 25.3 million. The doomsday scenario brought on by Terra’s (LUNA) collapse negatively impacted the decentralized finance industry, an event which was felt across the board on the smart contract blockchains. All things considered, investors should focus on the Ethereum network’s resilience during this unprecedented event.

To understand how professional traders are positioned, including whales and market makers, let’s look at Ether’s futures market data.

Ether futures shows signs of distress

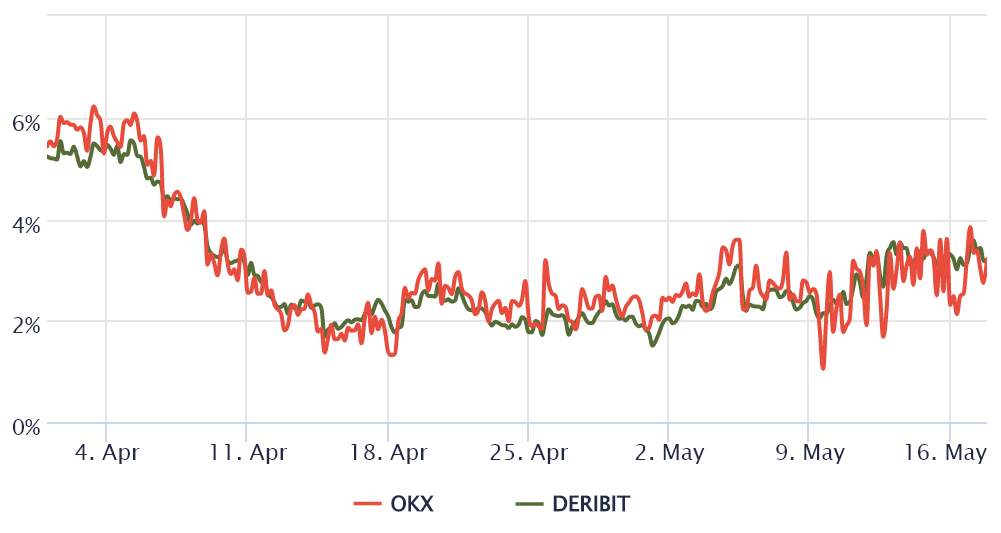

Quarterly futures are whales and arbitrage desks‘ preferred instruments due to their lack of a fluctuating funding rate. These fixed-month contracts usually trade at a slight premium to spot markets, indicating that sellers request more money to withhold settlement longer.

Those futures should trade at a 5% to 12% annualized premium in healthy markets. This situation is technically defined as „contango“ and is not exclusive to crypto markets.

As displayed above, Ether’s futures contracts premium went below 5% on April 6, below the neutral-market threshold. Furthermore, the lack of leverage demand from buyers is evident because the current 3.5% basis indicator remains depressed despite Ether’s discounted price.

Ether’s crash to $1,700 on May 12 drained any leftover bullish sentiment and more importantly, the Ethereum network’s TVL. Even though Ether price displays an ascending channel formation, bulls are nowhere near the confidence levels required to place leveraged bets.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.

One of the world’s largest cryptocurrencies, Ethereum, is facing a major challenge in trading as of late. According to two key Ethereum price metrics, traders are likely to have difficulty holding the current $2K support level.

The first metrics, Relative Strength Index (RSI), is a technical indicator that aims to measure the strength of a market’s movements so as to be able to determine whether a cryptocurrency is overbought or oversold. According to analysis of Ethereum’s RSI, it is currently indicating an oversold condition, meaning that the traders are likely to have difficulty keeping the Ethereum price above $2K support level.

The second key metric is trading volume. Ethereum is currently experiencing considerably lower trading volumes compared to its previous peaks. This could be interpreted as a lack of trust among traders, meaning that despite the current oversold condition, Ethereum may struggle to hold the $2K support level.

Given the current state of the two key Ethereum price metrics, it appears that traders may have a tough time holding the $2K support level for Ethereum. That being said, with the high level of volatility that exists in the cryptocurrency markets, Ethereum may still experience further gains from here. For now, traders should remain cautious and keep a close watch on the two key Ethereum price metrics in order to best assess the future of Ethereum’s trading.