DeFi lending protocol bZx endured another attack final night, the 2nd in 7 months.

This time, defective code was blamed for an exploit that permitted hackers to copy property, or maximize their iTokens balance devoid of the proper collateral.

Stories are circulating that hackers stole cryptocurrencies worth $8 million. But Anton Burkov, Co-founder of 1inch Trade, analyzed the pertinent DeFi explorer, removing duplicate items, as nicely as bZx “admin drainages”, to conclude these stories are significantly exaggerated.

In accordance to Burkov, the amount shed to the duplication exploit is nearer to $1.7 million. Further evaluation carried out by Burkov pinpointed the exploit to 9 transactions on the iETH lending token, value about 4.7k Ethereum in full.

“We found 9 exploiting transactions on $iETH lending token with 101778 $iETH tokens duplicated (value ~4.7K $ETH) // @DuneAnalytics”

Resource: twitter.com

In reaction to the exploit, bZx issued a statement declaring traders are lined by an insurance coverage fund paid for via treasury funds and protocol cashflow.

What is far more, in the statement, bZx spun the incident to reveal the soundness of the protocol.

“As we have shown ahead of, the system is able of absorbing black swan situations that would usually negatively affect financial institution property. Many thanks to a protocol style that anticipates and accounts for tail activities, this incident is surmountable. The financial debt will be wiped clean up and the protocol will transfer forward unimpeded.”

Nonetheless, thinking about the selection of superior profile exploits and exits going on in DeFi of late, this most current exploit has completed little to legitimize DeFi.

DeFi Hackers Exploit Duplication Bug

A postmortem of what took place demonstrates a number of failings. At first, Lead Developer at bitcoin.com, Marc Thalen, elevated the alarm by tweeting his discovery of the DeFi duplication exploit.

Nevertheless, due to time variations, no-1 at bZx was ready to respond straight absent.

1/4 Final night I located an exploit in BRZX. I found that a consumer were being capable of duplicating “i tokens”. There was 20+ million $ at danger. I knowledgeable the crew telling them to halt the protocol and spelled out the exploit to them. At this level none of the founders have been up.. pic.twitter.com/MdJqOH2IPu

— Marc Thalen (@MarcThalen) September 14, 2020

In the meantime, Thalen then went on to examination the exploit himself. He reported that he created a 100 USDC financial loan from which he was ready to assert 200 iUSDC.

“2/4 I tried using the exploit out. I established a loan making use of USDC (100 USD). From this I retrieved iUSDC. I then sent this to myself virtually duplicating the resources. I then developed a assert for 200 USD.“

By the time the bZx workforce was conscious of the problem, the attacker had now drained a substantial sum of DeFi belongings.

In response, bZx paused the minting and burning of iTokens as they investigated the promises. The group then utilized a patch to the iTokens contracts, correcting replicate balances at the same time.

Following that, ordinary action resumed.

What Next For bZx?

The bZx protocol was attacked in February in a flash lending exploit. Attackers were able to steal $350k by manipulating the Uniswap price tag feed for wrapped Bitcoin.

On the other hand, bZx denies the incident came about as a end result of applying Uniswap price tag feeds.

1/ Owing to the complexity of the transaction, providing a complete accounting of the losses will require supplemental time. This was not a easy Uniswap attack, and we do not use Uniswap as an oracle.

— bZx (@bZxHQ) February 15, 2020

At the time, bZx was rated as the 7th greatest protocol by complete benefit locked (TVL). But next the flash lending exploit, it began slipping down in the DeFi rankings.

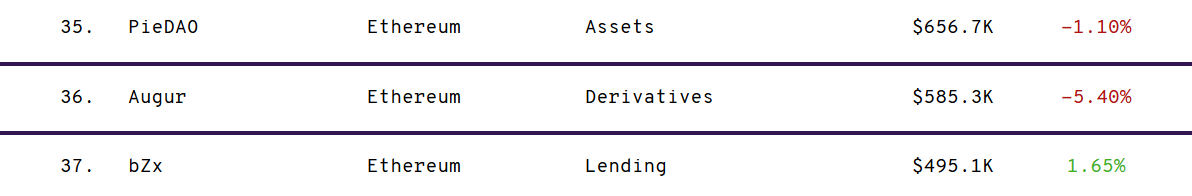

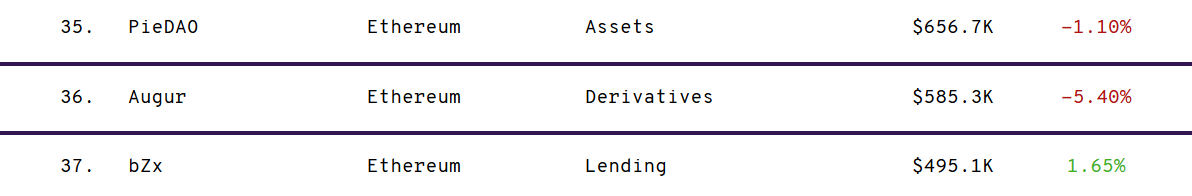

Today, defipulse.com ranks bZx as the 37th most significant by TVL, a significant tumble in standing.

Resource: defipulse.com

In a bid to reassure DeFi traders, bZx Co-founders Tom Bean and Kyle Joseph Kistner will industry thoughts about the incident later tonight.

Both of those our co-founders @tcbean & @BeTheb0x will be going Live to tackle any issues you may have relating to the iToken Duplication Incident.

Monday, Sep 14th at 9 am PT/ 12pm ET

Zoom: https://t.co/LO9Ys2PZIY

— bZx (@bZxHQ) September 14, 2020

But the real worry is no matter if today’s exploit will guide to a even more drop in standing.

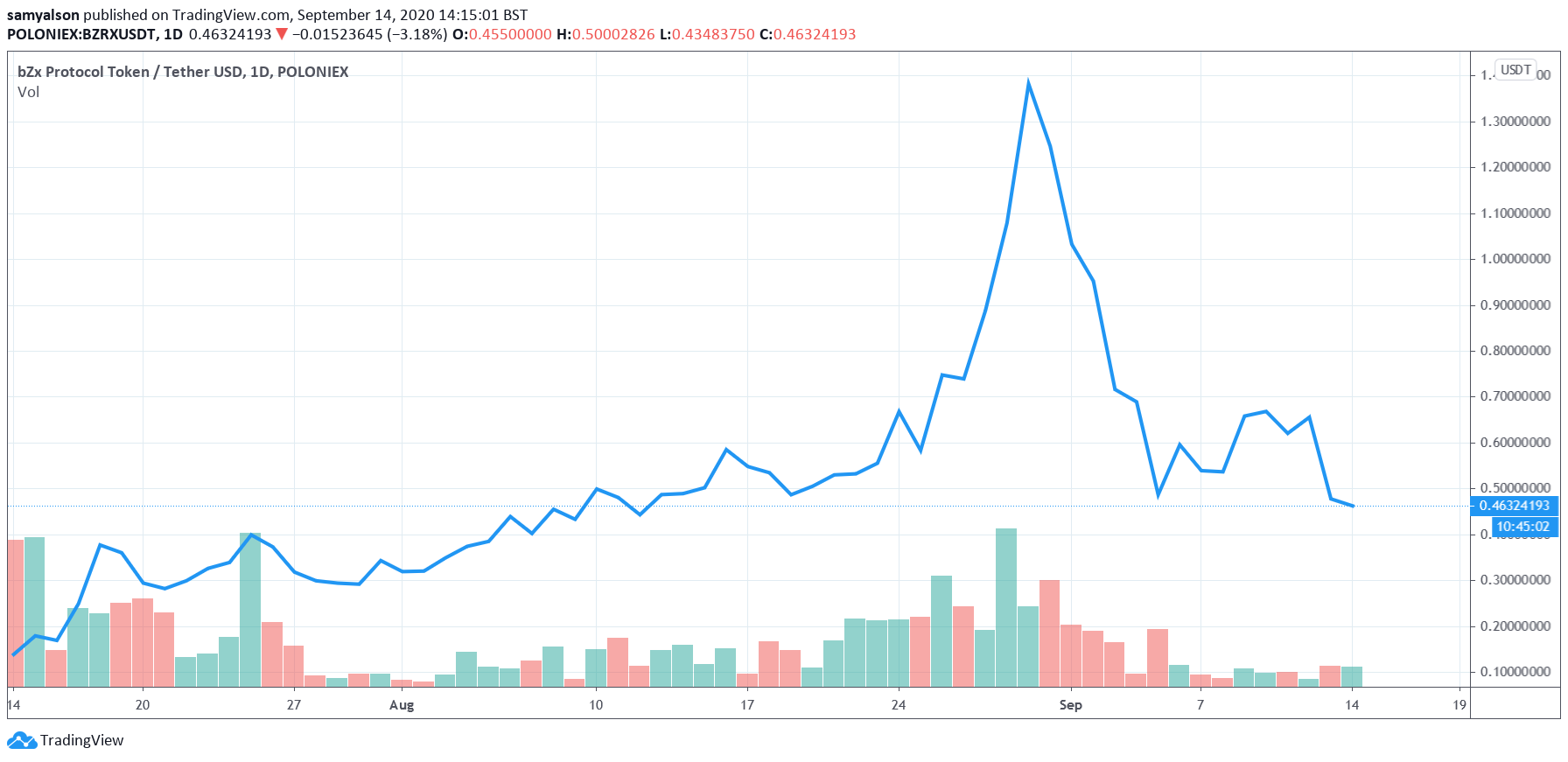

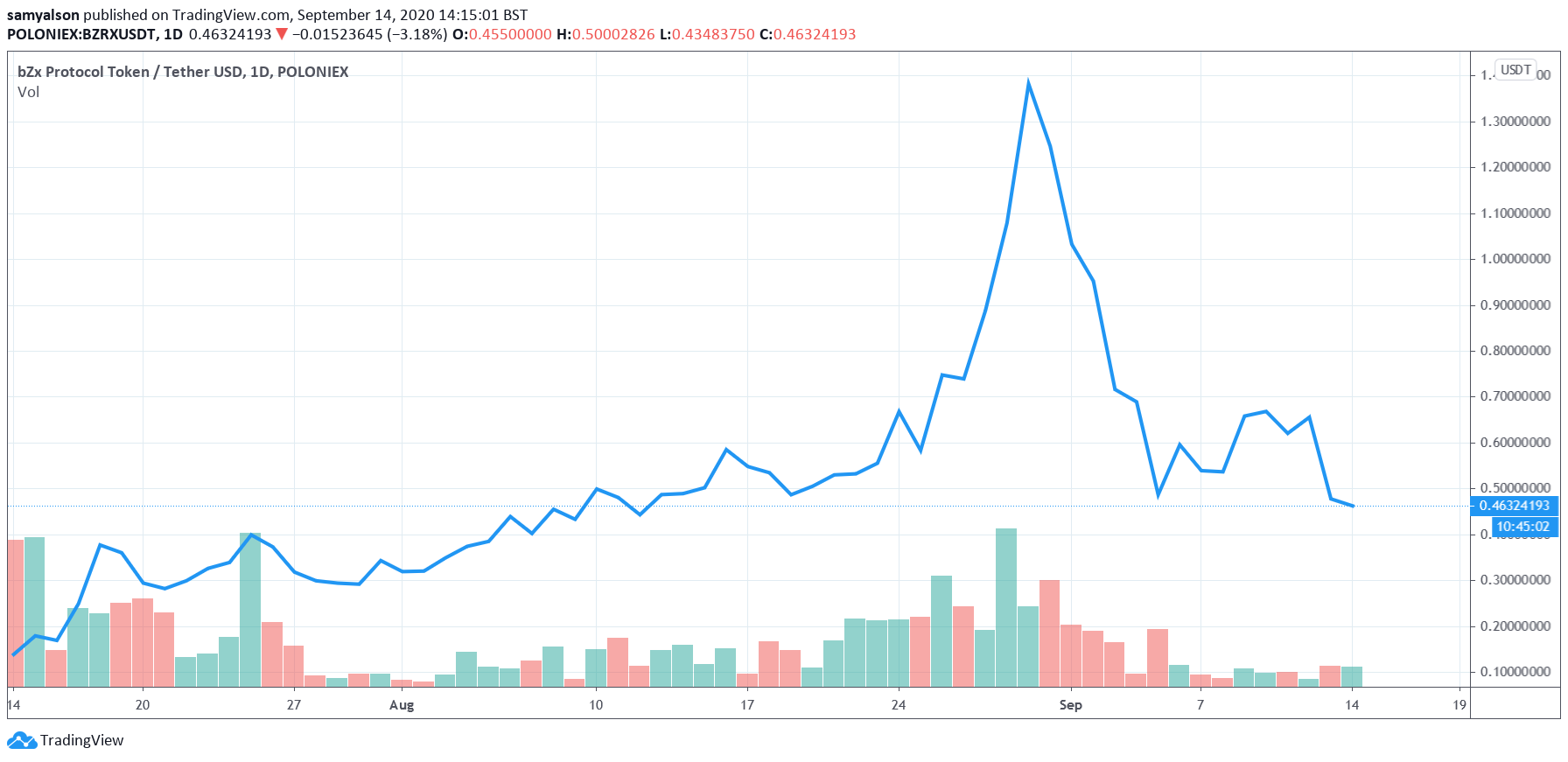

In conditions of token value, BZX is down 30% on the day. Nonetheless, will the duplication exploit direct to even further selling price declines?

BZX everyday chart with quantity. (Resource: tradingview.com)