Elon Musk revealed for the first time that his private rocket company SpaceX owns Bitcoin (BTC), and Tesla announced that it would likely resume accepting bitcoin as a form of payment for its electric vehicles. The value of Ethereum’s native cryptocurrency, Ether (ETH), soared sharply on Thursday as a result of these announcements.

It was below $30,000 before the big reveal, but the exchange rate jumped more than 5 percent after the announcement, reaching an intraday high of $32,895 after the announcement. The value of Ether, which has a tendency to move in lockstep with the flagship cryptocurrency, increased in a similar manner.

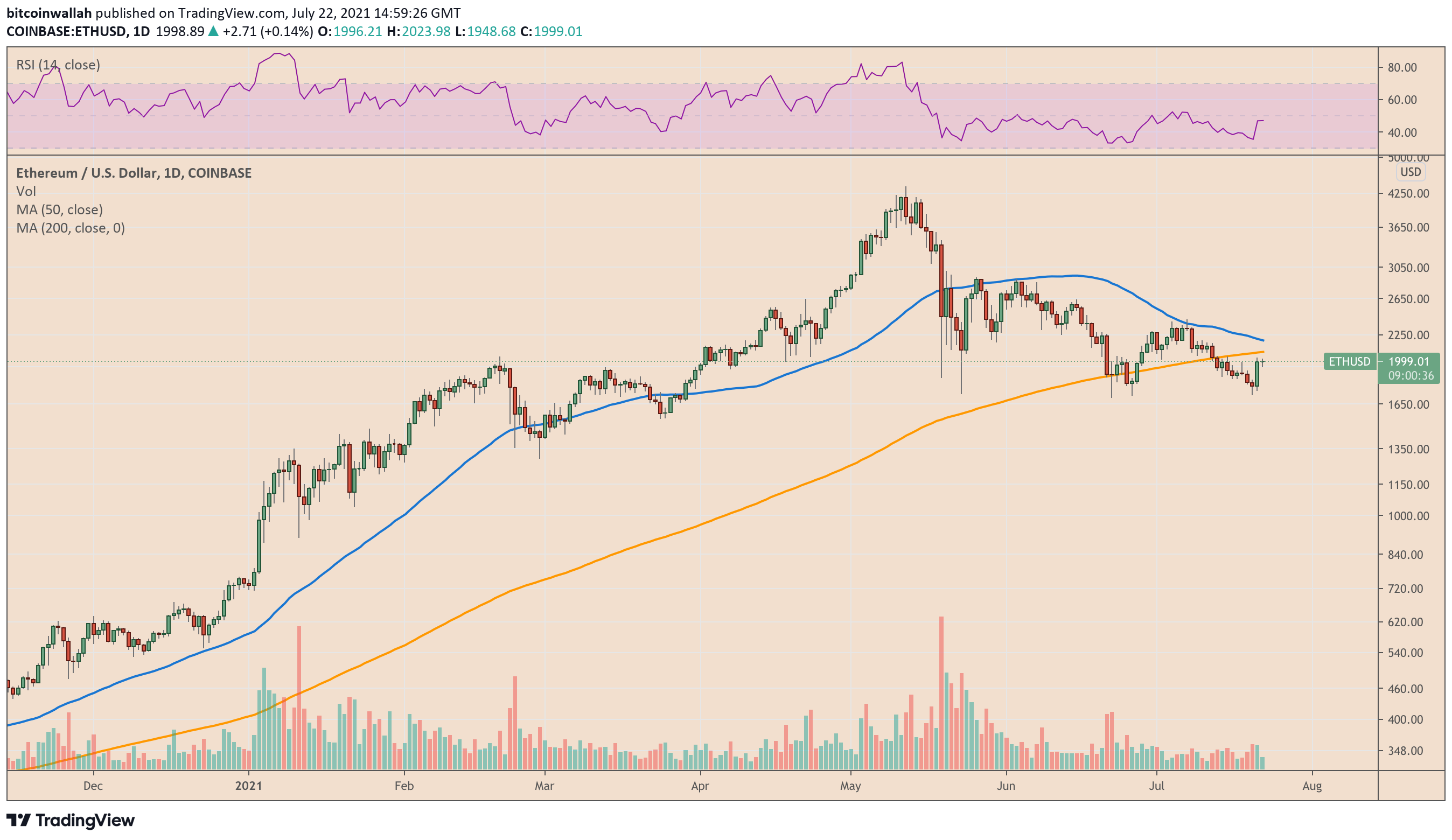

It regained $2,000 on Wednesday, gaining as much as 18.20 percent from its week-to-date low of $1,720, which was reached on Tuesday.

Following up on his previous statement, Lukas Enzersdorfer-Konrad, chief product officer at financial services company Bitpanda, told Cointelegraph via email that Ethereum would continue to trail Bitcoin in the coming sessions.

„As soon as the “big brother” finds its support level,“ he added, „Ethereum will most likely follow suit.“

Classic pattern sets $2.5K target for Ethereum

The recent rally in the Ethereum market was also triggered by a support level that previously capped Ether’s downside attempts.

On a weekly ETH/USD chart, an independent market analyst using the pseudonym Rekt Capital displayed a „orange area“ illustrating three bearish wicks and their ability to keep the pair from falling lower.

„ETH has rallied +16 percent since reclaiming the orange area,“ the analyst explained, tying the price floor to a support trendline that resembled a Falling Wedge.

Falling Wedges are bullish reversal patterns that begin broad at the top but contract as prices decline, forming a sequence of lower highs and lows.

A bullish confirmation occurs when the price breaks above the upper trendline of the Wedge, accompanied by a spike in volume.

Bulls do so by setting their upside profit target as high as the wedge’s maximum height.

Ether prices almost meet all of the criteria for trading within a Falling Wedge pattern.

The same point was made by Rekt Capital in a chart he published Thursday.

„As long as ETH holds the bottom of the structure as support until the end of the week, [it] will confirm a return to the structure after briefly losing it earlier this week,“ added Rekt Capital.

The maximum difference between the upper and lower trendlines of the Wedge is approximately $850.

A breakout above the upper trendline, in accordance with the classic technical setup, could send the price to at least $2,500 in the short term.

Despite this, a short-term technical setup, as depicted in the chart below, suggests that the prices could fall sharply below $2,000 in the near future.

According to Rekt Capital, the daily Ethereum chart indicates that the price could fluctuate between $1,850 and $2,080 before experiencing a potential bullish breakout.

According to Kirkpatrick and Dalquist’s book „Technical Analysis,“ falling wedges have a failure rate of only 8 percent to 11 percent when they fall.

Furthermore, the possibility of a bearish breakout has a higher failure rate of 15 percent to 24 percent compared to the other possibilities.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of CoinNewsDaily. Every investment and trading move involves risk, you should conduct your own research when making a decision.